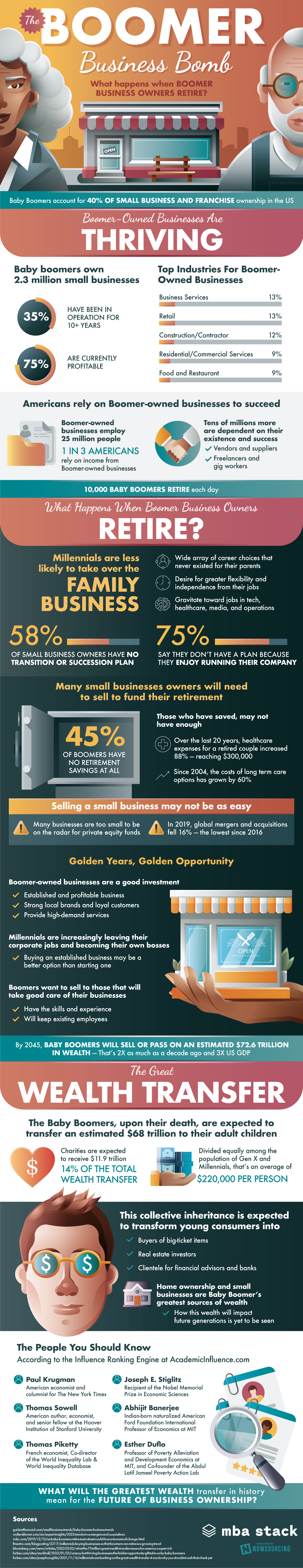

The Boomer Business Bomb

Share This Graphic About Boomer Businesses

Baby Boomers account for 40% of small business and franchise ownership in the US. This infographic explores what the consequences are for America as generations shift.

Boomer-Owned Businesses Are Thriving

- Baby boomers own 2.3 million small businesses

- 35% have been in operation for 10+ years

- 3 in 4 are currently profitable

- Top Industries For Boomer-Owned Businesses

- Business Services: 13%

- Retail: 13%

- Construction/Contractor: 12%

- Residential/Commercial services: 9%

- Food and Restaurant: 9%

- Americans rely on Boomer-owned businesses to succeed

- Boomer-owned businesses employ 25 million people

- Up to 1 in 3 Americans rely on income from Boomer-owned businesses

- Tens of millions more are dependent on their existence and success

- Venders and suppliers

- Freelancers and gig workers

- And more

- Boomer-owned businesses employ 25 million people

10,000 Baby Boomers retire each day

What Happens When Boomer Business Owners Retire?

- Millennials are less likely to take over the family business

- Wide array of career choices that never existed for their parents

- Desire for greater flexibility and independence from their jobs

- Gravitate toward jobs in tech, healthcare, media, and operations

- 58% of small business owners have no transition or succession plan

- 75% say they don’t have a plan because they enjoy running their company

- Many small businesses owners will need to sell to fund their retirement

- 45% of Boomers have no retirement savings at all

- Those who have saved, may not have enough

- Over the last 20 years, healthcare expenses for a retired couple increased 88% — reaching $300,000

- Since 2004, the costs of long term care options has grown up to 60%

- Selling a small business may not be as easy as expected

- Many businesses are too small to be on the radar private equity funds

- In 2018, private equity firms held $600 billion in uninvested capital — a 34% increase from a decade earlier

- In 2019, global mergers and acquisitions fell 16% — reaching the lowest quarterly volume since 2016 as uncertainty around COVID-19 grew

- In 2021, US mergers and acquisitions recovered, growing 55% and reaching a record $2.9 trillion

- Golden Years, Golden Opportunity

- Boomer-owned businesses are a good investment

- Established and profitable business

- Strong local brands and loyal customers

- Provide high-demand services

- Millennials are increasing leaving corporate jobs to become their own bosses

- Buying an established business may be a better option than starting one

- Many Boomers don’t want to sell to just anyone — They want a reliable successor who will take good care of their business

- Has needed skills and experience

- Will keep existing employees

- Boomer-owned businesses are a good investment

By 2045, Baby boomers will sell or pass on an estimated $72.6 trillion in wealth — That’s 2X as much as a decade ago and 3X US GDP

The Great Wealth Transfer

- The Baby Boomers, upon their death, are expected to transfer an estimated $68 trillion to their adult children

- Charities are expected to receive $11.9 trillion — 14% of the total wealth transfer

- Divided equally among the population of Gen X and Millennials, that’s and average of $220,000 per person

- This collective inheritance is expected to transform young consumers into

- Real estate investors

- Buyers of big-ticket items

- Clientele for financial advisors, banks, and more

- Home ownership and small businesses are Baby Boomer’s greatest sources of wealth

- How this wealth will impact future generations is yet to be seen

The Economists You Should Know

According to the Influence Ranking Engine at AcademicInfluence.com

- Paul Krugman

- American economist and columnist for The New York Times

- Joseph E. Stiglitz

- Recipient of the Nobel Memorial Prize in Economic Sciences

- Thomas Piketty

- French economist, Co-director of the World Inequality Lab & World Inequality Database

- Esther Duflo

- Professor of Poverty Alleviation and Development Economics at MIT, and Co-founder of the Abdul Latif Jameel Poverty Action Lab

- Abhijit Banerjee

- Indian-born naturalized American Ford Foundation International Professor of Economics at MIT

- Thomas Sowell

- American author, economist, and senior fellow at the Hoover Institution of Stanford University

What will the greatest wealth transfer in history mean for the future of business ownership?

Sources:

https://www.guidantfinancial.com/2020-small-business-trends/baby-boomer-business-trends

https://www.wolterskluwer.com/en/expert-insights/2022-trends-in-us-mergers-and-acquisitions